Why Keep Your Accounts In The Black

Understanding your money in a way that ensures you make it work as hard as possible for you and not the other way round, is important if you want your accounts in the black. This means that you are not using your overdraft and only spending money than you earn. Once you take the step into the red or you go into your overdraft, it is difficult to make your way out of the debt trap and back into the black. This is why it is so important to know your money and to keep track using a budgeting system.

How To Keep Your Accounts In The Black

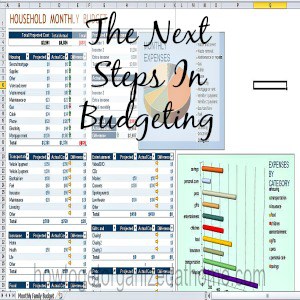

The best way to keep your accounts in the black is to budget, you have to work out how much money that you have coming into the household and how much you need to pay the bills and expenses; if there is more going out than coming in you have a problem.

Spending only the money that you earn and living within your means is the only way that you can and will stay in the black. So many companies advertise and push the idea of credit into our lives that it is becoming a normal part of life, having credit. However, you don’t have to have this expense in your life if you live within your means, it does mean that you have to budget and to work out your expenses each and every month. However, it is worth the effort not having to pay a credit company interest payments on money that you have borrowed to purchase an item, which in many cases if you budgeted correctly it might have been within your means quicker than you anticipated.

Learning to create a budget and to use it effectively is an important skill that many people struggle to learn, it isn’t something that’s taught in schools and this means it is something that young adults have to learn on their own, often the hard way, after racking up a lot of debt.

If you’re tempted to spend then using cash is a great way to train yourself not to over-spend. If you haven’t the money then you can’t have the item in question.

Protecting The Money You Earn

It might seem like an odd concept but it is important that you protect the money you earn, after all you will have worked hard for the money and protecting it and making it work as hard as possible for you is important. Having to use the money you have worked hard for to pay a credit company interest payments is a total waste, it can work a lot harder for you once your debt’s paid.

Take control of your money, don’t let credit companies entice you to spend more money than you can afford, you only end up paying vast amounts of interest on the money you have borrowed.

Where to keep your money. Don’t have vast sums of money in your home, it is not safe, it is important to make it work for you and the best place is in a bank, here you might even make interest on what you save. Finding the best bank account for your money is important; you will want to ensure that it meets your needs; if you want it to automatically pay bills then a savings account that you can’t withdraw from isn’t your best option.

Therefore, if you are looking for reasons to keep your accounts in the black then you must consider managing your money carefully. Work out a budget and spend less than you earn.

Great tips! Budgeting is soooo important! Thanks for sharing at Merry Monday, hope to see you again next week!

Budgeting is the key to financial success! Thanks for visiting 🙂